This blog post continues the unpacking of the key processes to successfully setting up a PMO.

It very surprising how many project managers do not see the requirement for accurate, transparent financial reporting of their project or programme.

To be clear, financial planning relates to the project manager creating a budget of the anticipated costs for delivering the project and then reporting progress against this budget (usually in the regular project status report).

In order to address this, a smart PMO will provide guidelines for budget planning and budget tracking.

Simple and effective guidelines would typically be:

1. Business Case

Ensure that all projects complete some form of business case that includes an estimated budget for delivering their project. Depending on the level of analysis, this may be a high level number. If the planning is more mature, this probably will have more detail, such as split between business, IT and external vendors, split by year and ultimately split by month.

2. Financial Baseline

The PMO should aim to develop a financial baseline for the project. This is the monthly anticipated spend over the duration of the project. This is useful as it gives a good indication of the amount of work that will be completed in any one month. It also allows for an organisation to plan cash flow requirements.

A good PMO will review the proposed financial baseline to make sure it makes sense i.e. not a simple straight line of the overall budget, no severe spikes that represent over optimistic (unachievable hiring of resources).

3. Financial Tracking

The PMO will work with the project manager on a monthly basis, to track actual spend against budget, update forecasts and evaluate if the project financials support the overall status being reported for the project.

By using trend analysis, a good PMO will identify where work is falling behind plan and budget simply being rolled and distributed over the remaining months (a clue that the project manager is not really re-forecasting). Another one to watch out for is where the project manager is reporting zero variance, it is extremley rare for a project not to have a variance. Another good indicator that the project manager is not re-forecasting and / or properly updating their forecast

To reduce the pain and effort of putting this financial planning and reporting process in place, the PMO should:

- develop simple (not over engineered) tools, to allow the project manager to plan and monitor progress.

- provide guidance on how and when the tools should be populated

- provide support to help populate the tools to create baselines (big help in improving data quality)

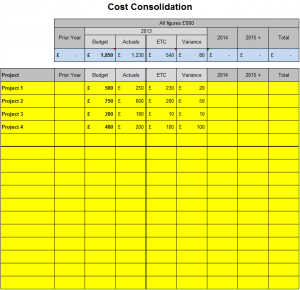

Cost Consolidation Template

Implementing a sound, common process will then allow the PMO to quickly roll up financials across all of the projects based on what should be good quality data. This in turn will promote confidence with senior management that the PMO has full control and oversight of the finances. It should also reduce the number of overruns and where there are, it will have been communicated and agreed – so no surprises, which helps keep the sponsor and stakeholders happy!